maryland student loan tax credit amount

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. How much money is the Maryland Student Loan Debt Relief Tax Credit.

Marylanders Encouraged To Apply For Student Loan Tax Credit

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

. If the credit is more than the taxes you would otherwise owe you will receive a. In Indiana for example the state tax rate is 323. Credit for the repayment of eligible student loans.

Marylands tax credit program for student loan debt relief has been in existence since 2017. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

The student loan debt relief tax credit may be claimed on form 502cr by certain qualified taxpayers in the amount certified by the maryland higher education commission. More than 40000 Marylanders have benefited from the tax credit since it. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Complete the Student Loan Debt Relief Tax Credit application. The program offers an income tax credit to residents who make payments on. From July 1 2022 through September 15 2022.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. 1 Best answer. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

Student Loan Debt Relief Tax Credit. Student Loan Debt Relief Tax Credit. Under Maryland law the.

Complete the Student Loan Debt Relief Tax Credit application. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. June 4 2019 537 PM.

Student Loan Debt Relief Tax Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Maryland taxpayers who have.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. Otherwise recipients may have to repay the credit.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Marylanders Encouraged To Apply For Student Loan Tax Credit Cbs Baltimore

Prince George S County Memorial Library System Applications For The Maryland Student Loan Relief Tax Credit For 2021 Are Due Tonight At 11 59pm Et If You Meet The Criteria Apply Great Opportunity

Student Loan Debt 2022 Facts Statistics Nitro

Tax Credits Deductions And Subtractions

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Verify Is Maryland Giving Students With Outstanding Debt A Tax Break For 2017 Wusa9 Com

Taxes On Student Loan Debt Relief Tiktok Search

9m In More Tax Credits Available For Maryland Student Loan Debt

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Comptroller Of Maryland Student Loan Debt Is A Mounting Crisis And That S Why We Offer The Student Loan Debt Relief Tax Credit Program The Tax Credit Will Be Available To

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

Biden Administration Eases Student Loan Forgiveness Through Income Based Repayment Plans Politico

Maryland Offering Tax Credit For Student Loan Debt Sc H Group

Tax Credit 2022 Deadline For Marylanders To Claim 1 000 Student Debt Relief In 13 Days Washington Examiner

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

New Maryland Tax Credit On Student Loans Lswg Cpas

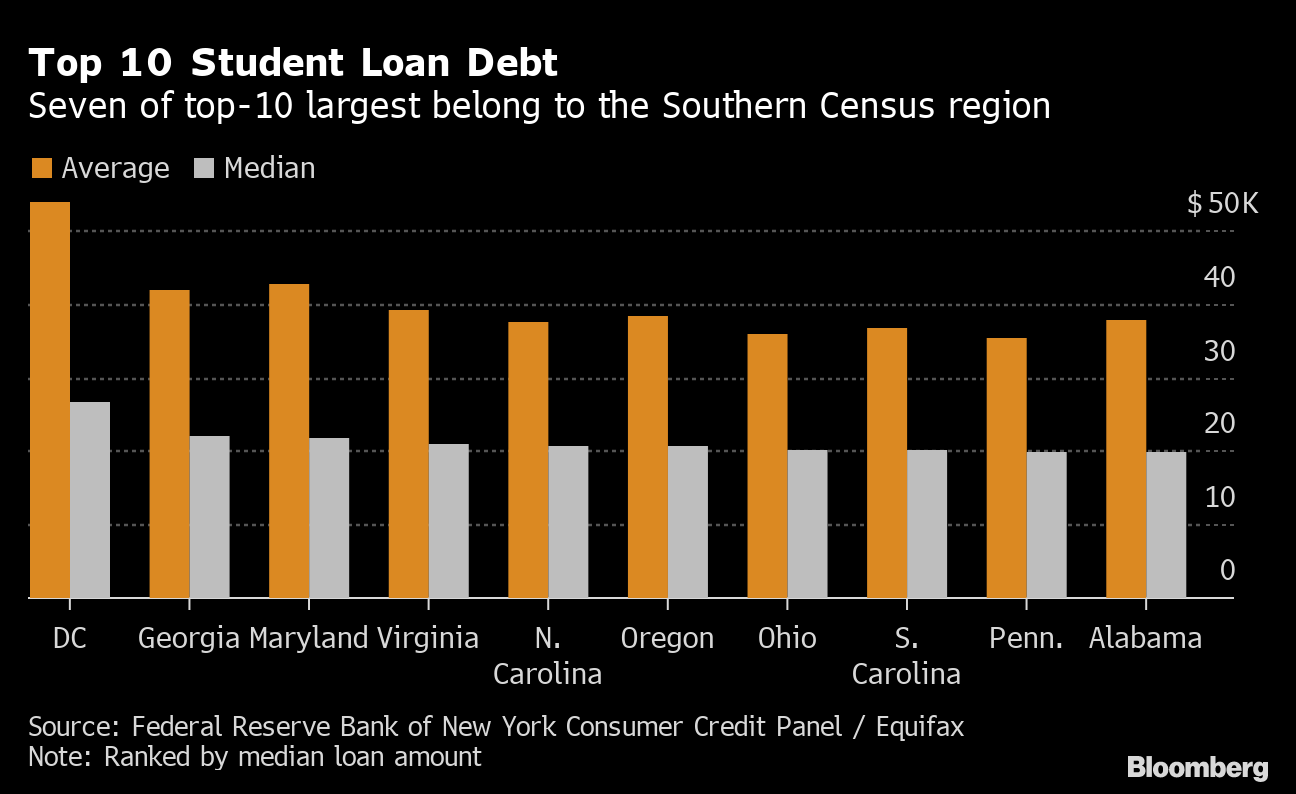

Student Loan Moratorium Boosts Credit Scores Especially For Delinquent Borrowers Bloomberg